Elected officials are voicing skepticism about a planned deal to sell Steward Health Care's physician network to for-profit insurer Optum, questioning whether it might do more harm than good as Massachusetts grapples with fallout from Steward's financial upheaval.

A day after regulators announced they would review a potential sale of Stewardship Health to Optum Care, House Speaker Ron Mariano said the transaction could "cause further disruption" and requires intense scrutiny.

"The proposed sale of Steward's physician group to Optum has the potential to significantly impact the competitiveness of the health care market in Massachusetts, and cause further disruption during a period of acute instability in the health care system," Mariano said Wednesday.

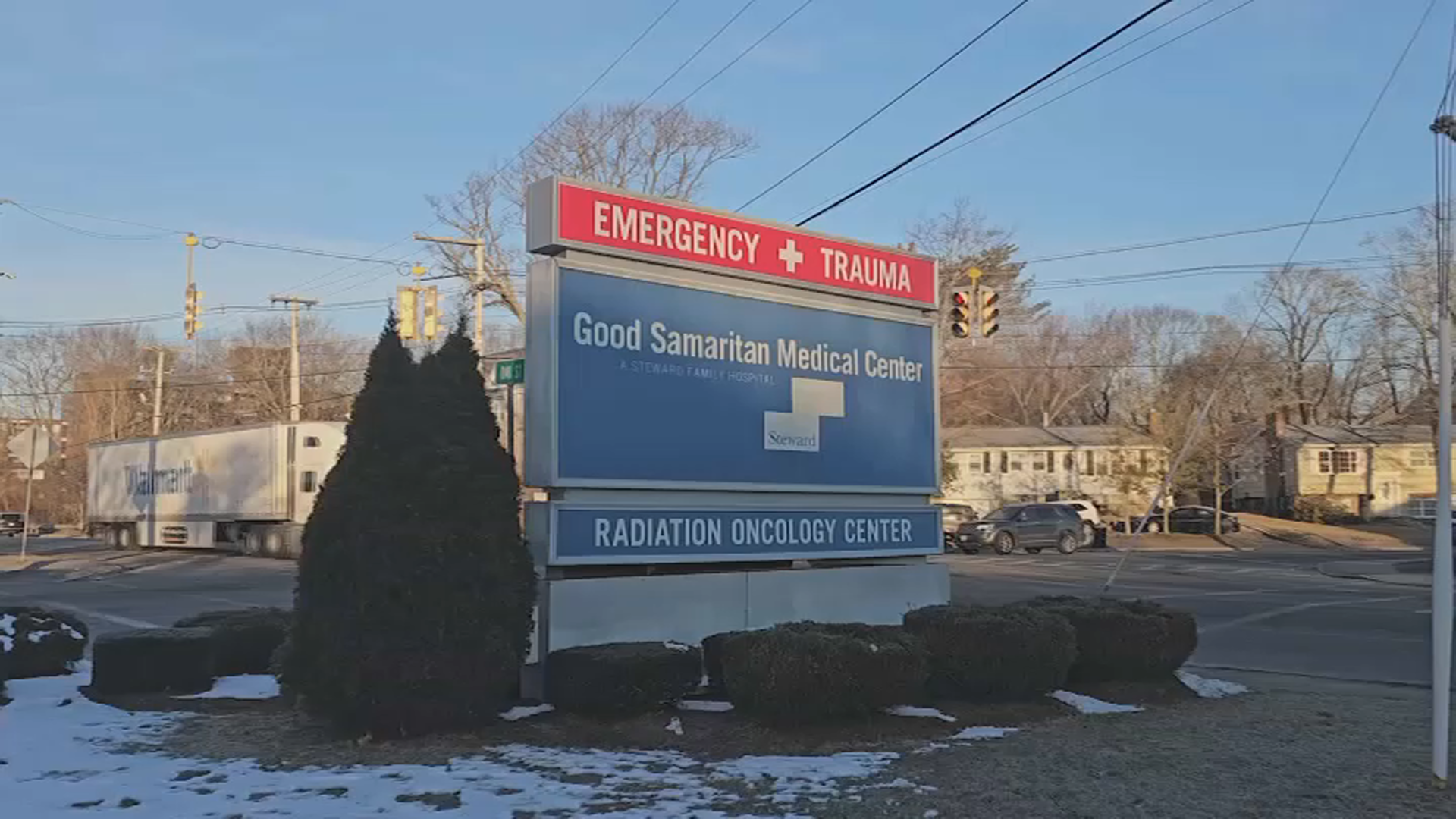

Steward, a for-profit, private equity-backed system that operates several hospitals in Massachusetts, has become one of the biggest boogeymen for policymakers since its financial woes burst into public view in January.

Get New England news, weather forecasts and entertainment stories to your inbox. Sign up for NECN newsletters.

The company filed paperwork with the Health Policy Commission on Tuesday signaling plans to sell its physician network to Optum Care, a subsidiary of the national giant UnitedHealth Group. Parties did not disclose financial details, but the sale could provide relief for Steward amid financial precarity, or serve as a precursor to offloading hospitals down the road.

Steward, whose leaders have faced calls to leave the state from Gov. Maura Healey and others, noted in one of its filings that it expects to disclose transactions concerning "certain of its acute care hospitals and other provider operations in the next 12 months."

The sale of Steward's physician network will not proceed until the HPC and other regulators complete a review of the proposal, according to HPC Executive Director David Seltz.

"As described in the notice, this is a significant proposed change involving two large medical providers, both in Massachusetts and nationally, with important implications for the delivery and cost of health care across Massachusetts," Seltz said on Tuesday. "Details of the proposal will be reviewed by the HPC to examine potential impacts on health care costs, quality, access, and equity."

Mariano, who has voiced his disdain for Steward and its decision to shutter a hospital in his hometown of Quincy, called on the HPC to consider the "vulnerability" of Steward's remaining hospitals and a federal antitrust probe as it examines the deal.

The Wall Street Journal reported last month that the U.S. Department of Justice is conducting an antitrust investigation into UnitedHealth Group.

"The HPC's statutory authority to review the health care impacts of this transaction should not delay state and federal antitrust authorities from doing their own rigorous review as we all seek to protect patient access and affordability, communities, employees, and the overall health care system," Mariano said.

U.S. Sen. Elizabeth Warren said that Optum already covers more than 10% of doctors in the country, making it the nation's largest employer of physicians. The deal, she said, "raises significant antitrust concerns."

"After years of gross profiteering and mismanagement, Steward's latest plan raises more serious questions about the future of the Massachusetts health care system," Warren said in a statement. "My top priority is ensuring Steward's Massachusetts hospitals remain open. But Steward executives have no credibility, and I am concerned that this sale will not benefit patients or health care workers, or guarantee the survival of these facilities. It would be a terrible mistake for Steward to be allowed to walk away while looting Massachusetts hospitals one more time."

A U.S. Senate subcommittee plans to meet in Boston next week to explore the impact of for-profit companies in the health care industry, and the delegation has set their sights squarely on Steward.

More on the Steward Health Care crisis

Warren and U.S. Sen. Ed Markey have repeatedly called on Steward Health Care CEO Ralph de la Torre to face questions at the hearing, seemingly without success.

"On March 7, we sent you a letter about these troubling transactions and Steward's role in this growing crisis, but nearly three weeks later, you have failed to provide us with any response," they wrote in a letter to de la Torre published Tuesday. "Investing in and operating a health care system includes a responsibility to the public, and you must answer for Steward's current financial insecurity and its impact on access to health care."

If regulators on the HPC determine the sale of Stewardship Health to Optum will inflict a significant impact on health care costs and the market, they can pursue a more expansive "cost and market impact review." But it's not clear how forcefully they could reshape the proposal.

"After Steward recklessly took on massive debt that is continuing to … put hospitals in Massachusetts and across the country into financial crisis, the Massachusetts health care system must move away from Steward's financial insecurity," Markey said in a statement Tuesday. "With this announcement, Optum must demonstrate that it can meet the even greater responsibility to preserve and protect health care access in the Commonwealth, and I hope they will live up to that responsibility by controlling costs and putting patients and providers first."

Leaders of the agency for years have urged the Legislature to award them with greater muscle to little avail. At a state legislative hearing earlier this week about private equity in health care, Seltz said other states empower regulators to deny or impose conditions upon health care transactions.

"That is not something the HPC currently has authority to do," he said Monday. "Our process is really a public report at the end of the day."

Steve Walsh, president of the Massachusetts Health and Hospital Association, said any sale of Steward's physician network "should center around the needs of patients and help stabilize -- not further harm -- the commonwealth's already fragile healthcare system."

"We believe a transaction of this magnitude must be subject to a stringent and transparent approval process that invokes Massachusetts' best oversight tools -- the very same oversight that local hospitals are held to," Walsh said.